Regardless of how outdated you’re, there may be all the time a price in saving into a pension scheme, significantly in case your employer is also keen to contribute.

definitions pension fund

NEA is dedicated to defending defined-profit pension plans because these plans provide a predictable, guaranteed profit. Often with pensions, in case you buy via a broker it would not hold any of the money, it merely acts as a conduit so that you can put the money into whatever funds or investments you need. And the key inquiries to ask are what type of plan it’s (for example, outlined profit or defined contribution?) and, until it’s a defined profit scheme, which pension provider your pension is with.

NEA is dedicated to defending defined-profit pension plans because these plans provide a predictable, guaranteed profit. Often with pensions, in case you buy via a broker it would not hold any of the money, it merely acts as a conduit so that you can put the money into whatever funds or investments you need. And the key inquiries to ask are what type of plan it’s (for example, outlined profit or defined contribution?) and, until it’s a defined profit scheme, which pension provider your pension is with.

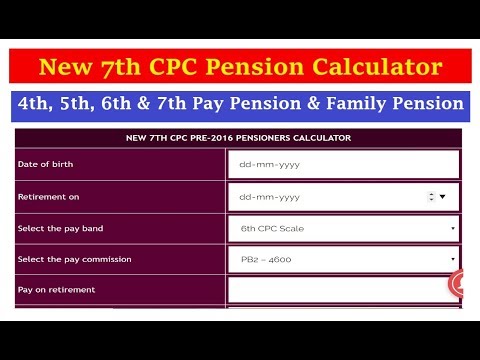

Plus, a pension’s just one type of retirement planning. Because it comes out of your PRE-TAX salary and straight into your pension, you pay much less nationwide insurance coverage (NI). In the event you only have final wage service after that date, or have any career average service, you may not obtain an computerized lump sum if you take your advantages.

Go to for more information on office and private pensions For more info on your particular occupational pension, communicate to your employer’s payroll or human sources department. And saving into one scheme does not imply you’ll be able to’t save into another or use other tax-efficient financial savings plans like ISAs.

Take the age you begin your pension and halve it. Then put this % of your pre-tax salary into your pension each year until you retire. If you’ve closing salary service that features service before 1 January 2007 you may obtain an computerized lump sum whenever you take your final salary benefits.

The Pension Protection Fund offers with defined-benefit schemes when an employer goes bust. The compensation payable to some members of the Teachers’ Pension Scheme could also be lower than the legal fees being quoted, and a few members may very well have gained from the modifications through which case no compensation would be payable.

what is a pension fund

You have another 5 qualifying years in your Nationwide Insurance report after 5 April 2016 (every year adding about £four.70 every week to your State Pension) equalling £23.48 a week. These statements include an estimate of the retirement earnings that the pension pot may generate if you attain retirement. If you are working within the unbiased sector you could have the choice to pay into a pension scheme arranged by your employer that both you and your employer make a contribution into.

conclusion

For most individuals, accessing pension money at 55 will be too early, so it will probably simply be left the place it is. But if you wish to, you possibly can entry all of your pension cash at once – the first 25% is tax-free and the remaining 75% can be taxed as revenue.